Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Quick Links

Gold Ownership Regulations Limited Collectors’ Choices in the 1960s

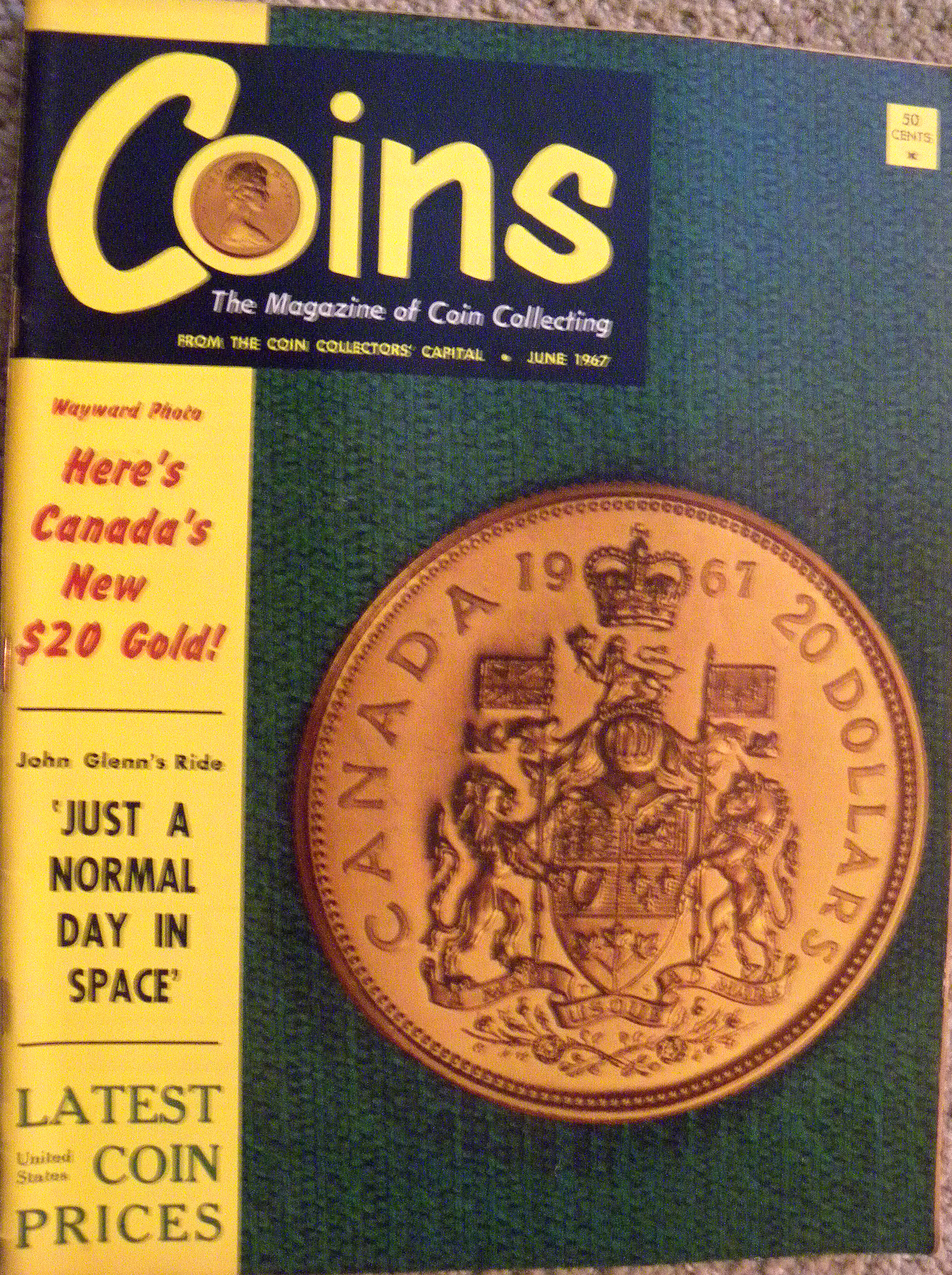

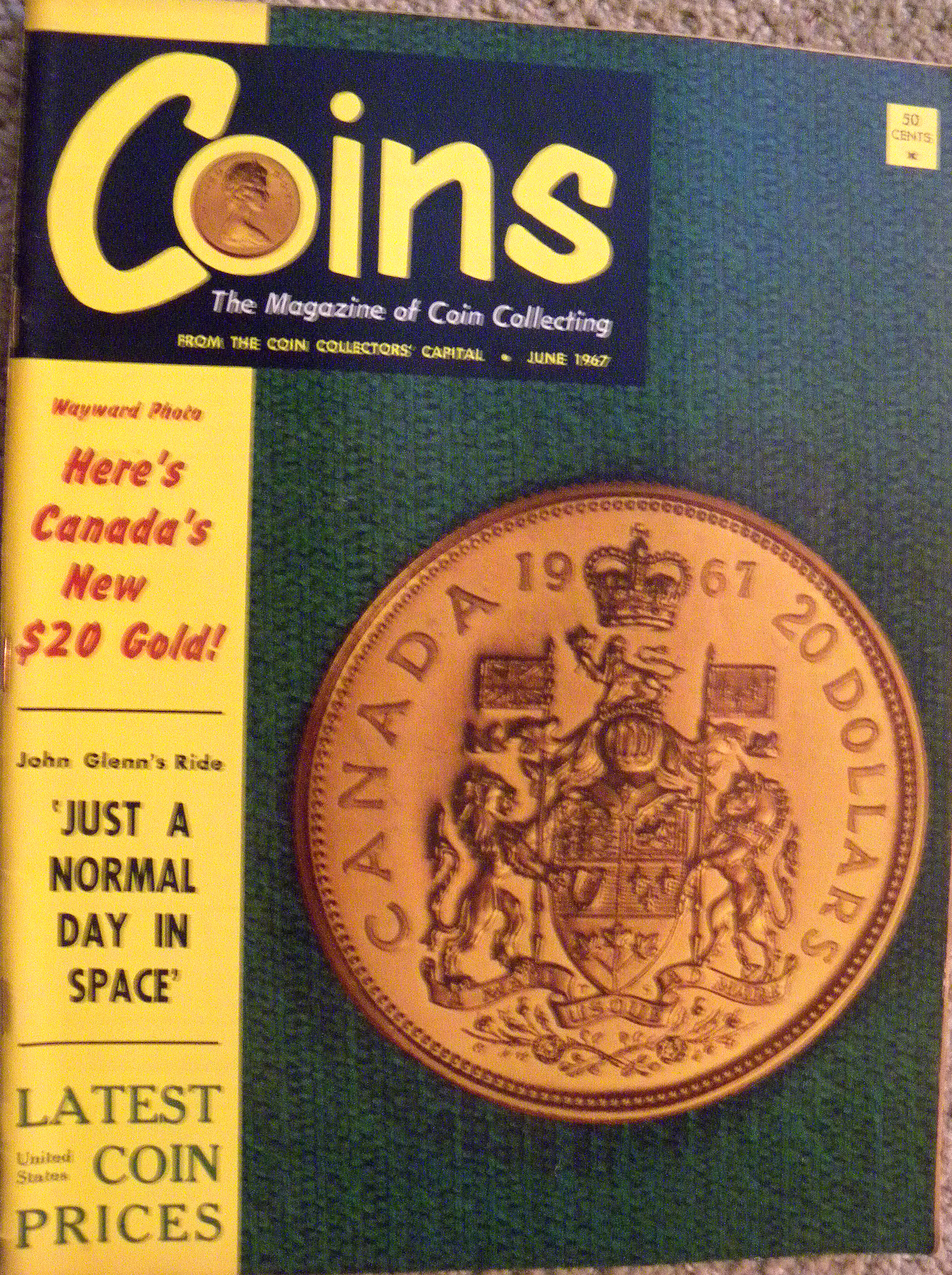

Recently I ran across a 1967 issue of the Numismatic Scrapbook magazine in my files. The magazine was a favorite among collectors from generations ago. It was published from 1935 to 1976. Ultimately it was “merged” with Coin World and eventually ceased to exist in any form to chagrin of some collectors.

Among the many ads, which contain thousands of coin prices from 50+ years ago (If we could only go back!), was an article that sounded a warning for dealers and collectors concerning gold. The article reminded dealers and collectors that they had to obtain a license from the Treasury Department before they could import any gold from abroad. The requirement for the license even applied to U.S. gold coins dated before 1933 which had been declared legal to own in prior rulings. Failure to obtain a license before the import transaction would result in confiscation of all of the gold.

These regulations stemmed from the Gold Surrender of 1933. President Franklin Roosevelt issued that executive order on April 5, 1933 to take control of the gold market. It was strengthened by two acts of Congress. The order required all citizens to turn in their gold coins and gold certificates for paper currency on or before May 1, 1933. Citizens were allowed to keep gold coins with a face value of up to $100. Exceptions were made for “customary use in industry, profession or art.” Those professions included artists, jewelers, dentists, sign makers and others who could show that gold was an essential part of their business. U.S. citizens were forbidden to hoard or invest in gold. They could not own gold and store it in a foreign country.

There was an exception for "gold coins having recognized special value to collectors of rare and unusual coins.” These included coins dated 1933 and before, although coins dated 1933 presented special problems. The gold eagles ($10 gold pieces) dated 1933 (Coinfacts estimate, 40 survivors) are legal to own, but subsequent court rulings have made all but one 1933 double eagle illegal to own. It is interesting to note that Louis Eliasberg, who assembled one of the most complete collections of all time, became a collector during this period.

Why did President Roosevelt take this bold action? The perception was that many people were hoarding gold coins and not spending them. Since the U.S. was on the Gold Standard, it limited the amount of money in active circulation which economists thought was stifling the economy during The Great Depression.

After Roosevelt confiscated the gold, he raised the price from $20.67 to $35.00 an ounce. That allowed the government issue more money and lowed the value of the dollar, which made U.S. exports cheaper and more attractive to foreign buyers. More exports increased the amount of goods produced. Both actions were directed to toward stimulating the U.S. economy and pulling the country out of the depression.

These actions had two adverse results for coin collectors. First, many collectable gold coins were turned into the government and destroyed. Second, collectors were barred in subsequent years from acquiring many desirable foreign gold pieces which were dated after 1933. For example, American collectors could not own the 1937 George VI coronation gold set nor many other interesting or significant coins or medals that might have interested numismatists.

At the time when the 1967 Numismatic Scrapbook article was published, Canada was issuing a 100th anniversary commemorative Proof set that included a very attractive $20 gold coin. Like all other late date gold coins, U.S. collectors were forbidden to buy it. Canada issued a set for Americans that had a silver medal in place of the gold piece.

Coins magazine sent a photographer and a reporter to Canada take photographs of the coin. It appeared on the cover of the magazine, and there was article about the “forbidden fruit” that American collectors could not have.

Unfortunately the provisions of the Gold Surrender Order remained in effect for 40 years. Finally President Gerald Ford signed a bill into law that ended the restrictions on American gold ownership. The bill took effect on December 31, 1974. Since then collectors have been able to add any and all genuine gold pieces to their holdings.

So, what has happened to the 1967 Canadian $20 commemorative gold piece that was “forbidden fruit” for American collectors? Once the allure of owning a forbidden coin was gone, and the years passed by, the interest in the piece fell to point where it now sells for close to its melt value. Sometimes when something is no longer banned, it becomes mundane.

Among the many ads, which contain thousands of coin prices from 50+ years ago (If we could only go back!), was an article that sounded a warning for dealers and collectors concerning gold. The article reminded dealers and collectors that they had to obtain a license from the Treasury Department before they could import any gold from abroad. The requirement for the license even applied to U.S. gold coins dated before 1933 which had been declared legal to own in prior rulings. Failure to obtain a license before the import transaction would result in confiscation of all of the gold.

These regulations stemmed from the Gold Surrender of 1933. President Franklin Roosevelt issued that executive order on April 5, 1933 to take control of the gold market. It was strengthened by two acts of Congress. The order required all citizens to turn in their gold coins and gold certificates for paper currency on or before May 1, 1933. Citizens were allowed to keep gold coins with a face value of up to $100. Exceptions were made for “customary use in industry, profession or art.” Those professions included artists, jewelers, dentists, sign makers and others who could show that gold was an essential part of their business. U.S. citizens were forbidden to hoard or invest in gold. They could not own gold and store it in a foreign country.

There was an exception for "gold coins having recognized special value to collectors of rare and unusual coins.” These included coins dated 1933 and before, although coins dated 1933 presented special problems. The gold eagles ($10 gold pieces) dated 1933 (Coinfacts estimate, 40 survivors) are legal to own, but subsequent court rulings have made all but one 1933 double eagle illegal to own. It is interesting to note that Louis Eliasberg, who assembled one of the most complete collections of all time, became a collector during this period.

Why did President Roosevelt take this bold action? The perception was that many people were hoarding gold coins and not spending them. Since the U.S. was on the Gold Standard, it limited the amount of money in active circulation which economists thought was stifling the economy during The Great Depression.

After Roosevelt confiscated the gold, he raised the price from $20.67 to $35.00 an ounce. That allowed the government issue more money and lowed the value of the dollar, which made U.S. exports cheaper and more attractive to foreign buyers. More exports increased the amount of goods produced. Both actions were directed to toward stimulating the U.S. economy and pulling the country out of the depression.

These actions had two adverse results for coin collectors. First, many collectable gold coins were turned into the government and destroyed. Second, collectors were barred in subsequent years from acquiring many desirable foreign gold pieces which were dated after 1933. For example, American collectors could not own the 1937 George VI coronation gold set nor many other interesting or significant coins or medals that might have interested numismatists.

At the time when the 1967 Numismatic Scrapbook article was published, Canada was issuing a 100th anniversary commemorative Proof set that included a very attractive $20 gold coin. Like all other late date gold coins, U.S. collectors were forbidden to buy it. Canada issued a set for Americans that had a silver medal in place of the gold piece.

Coins magazine sent a photographer and a reporter to Canada take photographs of the coin. It appeared on the cover of the magazine, and there was article about the “forbidden fruit” that American collectors could not have.

Unfortunately the provisions of the Gold Surrender Order remained in effect for 40 years. Finally President Gerald Ford signed a bill into law that ended the restrictions on American gold ownership. The bill took effect on December 31, 1974. Since then collectors have been able to add any and all genuine gold pieces to their holdings.

So, what has happened to the 1967 Canadian $20 commemorative gold piece that was “forbidden fruit” for American collectors? Once the allure of owning a forbidden coin was gone, and the years passed by, the interest in the piece fell to point where it now sells for close to its melt value. Sometimes when something is no longer banned, it becomes mundane.

Comments

Great start.

Back in the 1980s, Don Romano who ran the Worthy Coin Shop in Boston talked about how it was when his father was selling coins in the '40s. Back then, Don said that collectors had to wait to buy $20 gold pieces because the supply was short.

Most of the $20 gold coins we have today have come from Europe. They escaped the recall and melt because those coins were out of the country and owned by foreigners who could legally own American gold. Back in the '40s, I image that most of the $20s that were available here in the '40s had been saved domestically. You needed a permit to bring in the legal coins from foreign countries. Therefore the supply of American gold coins was limited.

It would still have been "legal tender"

At least domestically. wouldn't it?

It's the reason why there were commercial scales that were made to weight gold coins. Merchants could have them to weigh pieces before they would accept them. I don't collect those devices, but I have seen them offered by dealers and at coin shows. You put the coin on one end at specified areas on the bar. The gold dollar spot was at the end of the bar. The $2.50, $5.00 and $10.00 were closer to the fulcrum. I believe that there was a small weight you added to the end of the opposite bar for a $20.00 gold. If the scare didn't balance, the coin was short weight and not accepted, at least not at face value. The "Elender Scale" was brand name that comes to mind. There were others with different designs.